If your startup advisor or startup consultant encouraged you to analyse your KPIs to determine your ROI, would you know what this means? And, more importantly, would you understand their importance for you and your business?

KPI

KPI stands for Key Performance Indicators. KPIs are best described as signposts that give you an idea of how your startup is performing.

As you scale your business, you’ll no doubt set up various long-term or short-term objectives and milestones. After you have taken the appropriate measures to reach a particular company goal, you can then assess the quantifiable data that indicate how successful or unsuccessful those measures and goals were. These indicators are called KPI.

For example, if your new company strategy is to increase the impact of your digital marketing campaign on a social media platform such as Instagram, Facebook, or Twitter, then appropriate measures to achieve this could include increasing the number of posts created or better optimising their content to reach the right target audience.

A key performance indicator associated with this objective would therefore be to measure the volume of traffic to your page after these posts or to analyse audience engagement using Google Analytics. If your KPIs are showing to be going in the right direction, then your marketing team could in the future consider redirecting budgets to digital marketing efforts and cutting down on marketing costs in other areas.

ROI

ROI stands for Return on Investment. It denotes what you have gained from your expenditure. This could include the net profit made from a sale or the financial success of an investment made into new marketing campaigns.

If you’re an agile business adapting to market trends to elicit company growth, then figuring out your ROI would help you discover how successful you have been with this.

For example, investing in better quality webcams for your employees who are working from home could be considered a positive ROI if they have shown to improve employee efficiency during team meetings, or perhaps customer service when speaking with clients.

Better quality video calls thanks to this investment could even have a positive ROI by helping you maintain a more professional image and therefore be more likely to seal the deal with investors.

Another example of a positive ROI could be hiring a startup consulting firm or a business consultant for startups. Hiring an outside source to help scale your startup is an action that may cost money but will ultimately bring your business a positive ROI thanks to their expert knowledge.

However, calculating ROI doesn’t only involve calculating the revenue and net profit, but also considers what you could have spent that money on instead, such as a different marketing strategy you already know to be successful.

It even considers what your investment could end up bringing you, such as a higher customer retention rate and therefore stronger customer loyalty.

What Does This Mean For Me and My Startup?

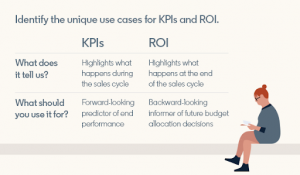

Now that the basics and differences of KPIs and ROIs are covered. It’s important to highlight how collecting and analysing this data could help you to grow, flourish, and reach your business objectives.

A Better Future

As discussed, KPIs and ROIs are a form of assessment that show how your business is currently doing and how well your investments and measures have paid off.

Knowing whether an investment was successful or not can help you make informed decisions and gauge how and where to allocate both your budget and time in the future. But to get the most of the data accumulated by KPIs and ROIs, you should make sure to accurately analyse them both.

This is because KPIs only give a general sense on how your investment is performing – they show your investment’s short-term impact.

This means that whilst assessing the key point indicators is important. In order to know the true impact of your investment and to predict its trajectory you’ll have to also calculate the return on investment.

A Better Company

KPIs and ROIs could also help bolster company culture by giving your team clearly defined goals. Company culture is a key factor in scaling your business to new heights, so keeping your team in the loop with clearly communicated KPI and ROI data makes sure they not only know how they’re doing, but also whether or not their work has paid off to achieve set objectives.

Promising KPIs and a positive ROI could boost morale in your team, thus increasing employee satisfaction and efficiency. This in turn accumulates even more ROI!

On the other hand, bleak KPIs and a negative ROI, whilst not favourable, do help explain what went wrong and where. Negative results such as these can only serve to inform future decisions and keep your team motivated and on track.

A Better Chance with VCs

Venture capital consulting firms would also encourage you to not only share your KPIs with employees, but with all stakeholders as well, such as with investors during a pitch deck.

It should be communicated clearly what these KPIs signify and what they could denote for the future.

Additionally, another benefit to KPIs and ROIs for your company is that potential investors doing due diligence will consider your startup’s ROI history before making their decision to invest or not.

So making your own well-informed choices will undoubtedly have a positive impact on the investments made into your startup’s future.

We all know startups are a long-term game. Measuring KPIs and ROIs will help business owners grow from startup to scaleup (and even perhaps Unicorn!). For a more thorough reading on the same topic, read KPI vs ROI here!

Amit Khanna, 7startup Founder

Amit has 18 years of experience in the industry and an MBA. He supports entrepreneurs with every aspect of their business including concept and product development, investor presentations, and fundraising. Amit & 7startup assist startups in the pre due-diligence process and help connect them to our vast network of investors. Reach out to us today and see if we’re a fit!