Deep Tech startups are at the forefront of technological innovations and advancements, using scientific research and development to solve some of the world’s most complex challenges. Artificial intelligence (AI) technology known as deep learning trains computers to analyse data in a manner modelled after the human brain. The potential for these ventures is immense, but scaling and growing a deep tech venture comes with its unique set of challenges. In this blog, we will explore the art of fuelling the growth of a deep tech venture and the key factors that determine its success. We will draw from the experiences and insights of several successful deep tech ventures and industry experts.

Defining Deep Tech Startups

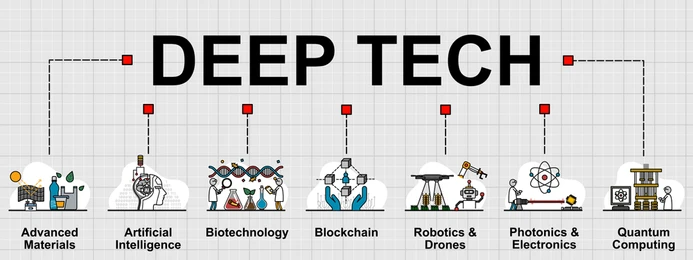

Deep Tech ventures refer to startups that are built upon a new and foundational technology that can fundamentally change how an industry or the world works. These companies use scientific research and development to create innovative solutions that solve complex problems that are beyond the scope of regular startups. Some of the areas that deep tech ventures operate in include biotechnology, quantum computing, semiconductors, blockchain, cyber, and robotics. Deep tech startups and deep learning have made significant strides in recent times.

The Growth Journey of a Deep Tech Startup

Growing a successful deep tech venture requires passion, commitment, and bordering obsession for their very niche line of work. Deep tech ventures have a longer and more arduous scaling journey compared to other startups. Typically, it can take between 8-12 years for VCs to see returns, versus 3-5 years for regular startups.

To progress from running lab-based experiments to prototyping products, deep tech startups require significant investment and support at a very early stage. But, typically, significant investment is hard to come by without a prototype already developed and proven, which puts many entrepreneurs in a catch-22 situation.

The Scaling Challenge

The scaling challenge for deep tech ventures changes as they mature. While initially, the focus may be on creating interest in the market, it later becomes more about solving customers’ problems. Diffblue, a deep tech startup, that saves developers time by automating the writing of code, span out of Oxford University in 2016. It raised the largest AI Series A funding in Europe with Goldman Sachs a year later. The first thing you look for in a deep tech investor is somebody who really understands the space you are in and the problem you are trying to solve,” says CEO Mathew Lodge.

He adds, “Goldman Sachs invested in us as they understand our challenge, and they have been great at introducing us to their customers to help us build our pipeline.” As deep tech companies scale, it becomes less about focusing on the technology and more about solving their customers’ problems.

Scaling Through Tech

Deep tech startups can unlock scalability from the tech side. Cardiff-based AMPLYFI, a deep tech company whose Insights Automation Platform uses machine learning to help organisations generate revenue from their research, has seen its scaling challenge transition in recent years from “creating interest” to “scaling delivery”.

“The most recent jump in scaling up has been embedding our capabilities in a range of intuitive applications,” says Head of Marketing Warren Fauvel. “This has enabled us to operate in a more scalable, market-driven, and self-service manner – driving costs down and return on investment up for our customers.”

Pivoting from Deep Tech to Enterprise SaaS

Some deep tech startups pivot and change direction altogether. Darktrace and simulation software Unicorn Improbable, both began as deep tech before pivoting to Enterprise SaaS. However, pivoting can be a difficult decision for any startup, but it can be especially challenging for deep tech ventures that have invested significant time and resources in developing a particular technology. However, pivoting can also be a necessary step for growth and success. Darktrace and Improbable are just two examples of deep tech startups that successfully pivoted to become enterprise SaaS companies.

Darktrace, which provides AI-powered cybersecurity solutions, initially began as a deep tech startup focused on developing an autonomous intelligent system for detecting cyber threats. However, the company realised that its technology was best suited for the enterprise market, and pivoted to become an AI-powered cybersecurity platform that helps organisations detect and respond to cyber threats.

Improbable, on the other hand, started as a deep tech venture focused on developing virtual worlds for gaming and simulation applications. However, the company struggled to find a market for its technology and eventually pivoted to become an enterprise SaaS company focused on providing simulation solutions for industries such as transportation and defence.

The decision to pivot can be difficult, but it can also be a necessary step for a deep tech startup to achieve growth and success. It is important for startups to remain flexible and open to new opportunities, while also staying true to their core values and mission.

Building a Strong Board and Team

As deep tech companies begin to scale, it becomes less about focusing on the technology and more about solving their customers’ problems. This requires a strong board and team that can provide the necessary expertise and guidance to navigate the challenges of scaling.

A strong board can provide valuable insights and advice on strategy, operations, and governance. It can also help with fundraising and networking. Jane Silber, the former CEO of open-source company Canonical, is praised by Mathew Lodge, CEO of Diffblue, for her great operational experience and ability to help the company think through different challenges and problems.

In addition to a strong board, it is also important to build a talented team with specific knowledge and experience requirements. Deep tech startups require individuals with expertise in their field, but this expertise does not necessarily translate to sales or legal expertise. As Ash Ravikumar, Entrepreneurship Development Officer at CERN research lab, advises, a good startup will hire a VP of sales or marketing in its target market to address a weakness and scale that function out.

Recruiting can be a particular pain point for deep tech scale-ups, especially those in smaller sub-sectors such as space tech. Startups need to “hire smart” to plug gaps in their own capability. Recruitment can be facilitated by collaborations with higher education institutions, which can provide access to specialised talent.

Finding the Right Investors

Investment is critical to scaling deep tech businesses, both for the capital and the connections and expertise that come with it. Deep tech companies have a very different risk profile compared to other startups, and this will change significantly as the company grows. In practice, this means that founders must adapt their pitch and proposition along the way.

The main barrier to scale is access to investment, and it’s really important for the leaders of any space tech company to strike the right balance during the scale-up transitions. Startups need to identify investors who understand their challenge and have experience in the space they are in.

For Alex Van Someren, a capable team – defined by its “level of drive, persistence, creativity and intelligence” – is the most important quality in an investable deep tech company. The second is the size of the growth opportunity. Most deep tech businesses will fail, normally due to an inability to find product-market fit, under-(or over-) investment, or failure to execute on a sales and marketing plan. To balance the risk, investors seek companies targeting markets “in the billions”. Timing can be a critical factor for success in the deep tech industry, as the technology itself is continually evolving, and it can take time to establish a product-market fit.

Fuelling the Growth of Deep Tech Startups

Fuelling the growth of deep tech startups requires a unique set of skills, resources, and strategies. The journey from lab-based research to commercialisation is long and arduous, and deep tech startups must navigate multiple phases, each with unique challenges.

To succeed, founders need to have a clear understanding of their target market, a solid product roadmap, a strong team with diverse skill sets, and access to the necessary resources and funding. They must also be willing to pivot and change direction as needed and be able to adapt to the rapidly evolving technological landscape.

Investors, on the other hand, must have a deep understanding of the deep tech industry, be willing to take on a higher level of risk, and have the financial resources to support startups through multiple stages of growth. They must also be patient and understand that deep tech ventures often require more time to see returns than traditional startups.

The deep tech industry represents a new era of advances in technology, offering the potential to solve some of the world’s most significant challenges. While it is a complex and challenging industry, the rewards of success are enormous, with the potential to transform industries, save lives, and change the world.

If you enjoyed reading this, you may also want to read – Challenges in scaling Deep Tech Startups in Europe

Amit Khanna, 7startup Founder

Amit is an investor and advisor with two decades of experience and an MBA. He supports entrepreneurs with fundraising & go-to-market expansion in Saudi Arabia. His strategy is built on two pillars: deep investment acumen and a vast operational network. Reach out to us today and see if we’re a fit!