What is more difficult than starting a business? Keeping it operational. VC investment has continued to decline from record levels in 2021, falling 37% in Q3 2022, from $60 billion in Q2 to $37 billion invested. Despite this steep decline, 2022 is already the second-highest investment year on record. Furthermore, experts predict total investment to exceed $200 billion for the second year in a row, marking the fifth consecutive year of more than $100 billion in VC investments.

Approximately 20% of startups fail within the first year of operation. This is why understanding what your startup runway looks like is critical. The amount of time before your startup runs out of money at its current rate of income and expenditure is referred to as a startup runaway. Let’s take a closer look at how you can calculate and extend your runway to help you make the most of your startup’s funds.

What is Startup Runway?

According to experts, startups should have a runway of 12-18 months on average. Others however have far higher recommendations and say you should aim for 2 years. This is dependent on your startup as all startups in different industries have substantially different qualities. Consider the startup runway to be the actual runway where a plane takes off or lands. The weight and overall size of the plan determines the length of runway needed. Similarly, the amount of money a startup requires to stay afloat is determined by the product or service it provides.

However, in order to calculate your startup’s runway, you must first determine your startup’s gross burn rate and net burn rate.

Gross Burn Rate

The gross burn rate is the amount of money spent by your startup each month. You can calculate this by deducting the remaining funds from the original fund amount and dividing the result by 12 months. For example, suppose you have $100,000 in your bank account at the start of the year and only have $30,000 at the end. Then your gross burn rate is $5,833.33.

Net Burn Rate

The net burn rate is the rate at which you lose money. It is the difference between the money coming in and the money leaving the organisation. Subtract your company’s monthly earnings from the gross burn rate to arrive at this figure. Using the same example from the previous section, if you earn $2,000 per month, your net burn rate is $3833.33.

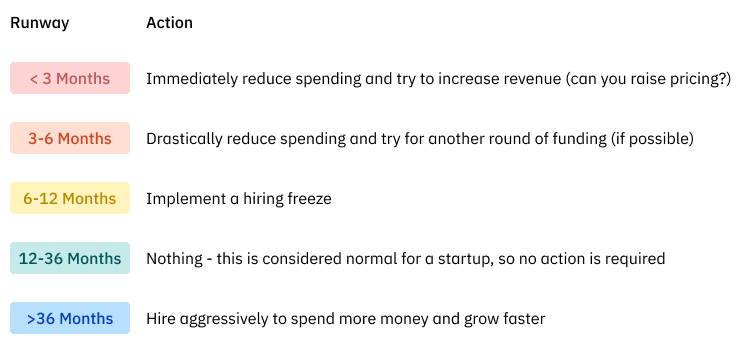

You can calculate your startup runway by dividing your initial investment (i.e., $100,000) by your net burn rate (i.e., $3833.33). It will tell you how many months (i.e., 26) until your company goes bankrupt. Knowing how long it is can help in deciding what steps to take to extend your runway.

How to Extend Your Runway

To extend your runway, the main focus must be reducing your burn rate. To do this, you must decrease spending and increase cash inflow.

- Slow down your plans for expansion: Expansion into a new location or market may rapidly become expensive. To reduce burn rate, abandon plans for new markets, halt growth in newer ones you’ve just begun in, and double down on existing ones.

- Aim for more spending, rather than more customers: Encourage clients to buy more if you are a B2C firm and your business plan enables it by offering a greater range of items, better service, and discounts on multi-purchases. The average transaction value will thus increase the profitability of each delivery. It simply does not work when customers make tiny transactions with low margins and delivery costs rise.

- Budget consolidation: Startups will frequently assign budgets to particular departments or projects. Instead of relying just on growth figures, modify your plan to view it as a single central budget. Each moving component should aid the other. Centralising the budget also improves visibility for the CFO, allowing them to know when to speed up certain tasks again.

- Make it clear that you’re putting profit above expansion: You want the team to consider every single dollar they spend. The main message is that cutting costs everywhere saves the organisation and jobs. Every expenditure should have a business case since teams frequently underestimate costs and exaggerate benefits. You don’t simply want to save 20% of your expenditure; you don’t want to spend anything unless it’s absolutely required to survive.

- Keep investors informed: Your expansion plans will differ from the ones you initially offered to investors. You must communicate your market reevaluation and plan with them in order to keep them on board in the long haul – you may need to raise additional money from them in the future. Explain to your investors that owing to the current status of the market, you will not be raising funds anytime soon, or at least not under favourable terms, and that because you can’t obtain funds, you won’t have a liquidation event in the next few years – at least not one with a high internal rate of return (IRR). They must understand that you are playing the long game.

If you’ve enjoyed reading this, you may also like – 5 SKILLS NEEDED TO BE AN ENTREPRENEUR

Amit Khanna, 7startup Founder