If you’re thinking about investing, you’ve probably heard good things about stocks and options for startups, but you might not be sure which is best for you. When it comes to investing, there are a few things which are already in your mind. For instance, you’re looking for strategies. You want knowledge that will help you become an investor, not just someone who makes investments.

Trading stock options is quite different from trading equities since options have different characteristics than stocks. When forming a corporation, you have the option of issuing ordinary stock or preferred stock to investors. In exchange for capital, companies give equity shares to investors. This capital is used to expand and operate the startup.

If you intend to make the right choice between Stock and Options, you should read this article.

What are Stocks?

The objective of stock investing is to purchase shares at a low price and then sell them at a higher one. If the company’s worth grows, you may benefit from capital gains. This helps a startup to become a scaleup. Common shares and preferred shares are the two types of stocks that make up a startup’s equity stock.

The founders or partners own the stock of privately held firms, scaleups or partnerships. Shares in small businesses are sold to outside investors on the primary market as they become a scaleup. Friends or family members may be among them, followed by Angel or venture capital (VC) investors. Stocks may be a smart choice if you’re searching for a simple approach to start investing for a goal that’s more than five years away, such as retirement.

Drawbacks of Stocks

Stocks come with a risk that the price might drop, and you could lose all or part of your investment. Because individual stock performance can be unpredictable daily, experts typically advise investing in stocks with money you won’t need for at least five years. To decrease risk even further, avoid putting all of your money into a single investment.

What are Stock Options?

Trading options is not the same as trading stocks in startups or scaleups since options have various features. Before trading options, you should familiarise yourself with the language and ideas involved.

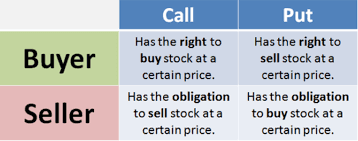

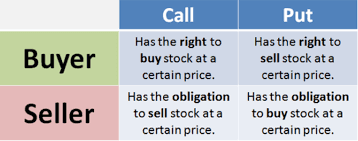

Options are financial derivatives, which means that the underlying investment or stock determines their value. You are given an option to purchase or sell the underlying shares at a predetermined price, but not the responsibility to do so.

You buy a piece of the firm that issued the stock when you buy one or more stock shares. The objective of stock investing is to purchase shares at a low price and then sell them at a higher one.

Calls and puts are the two fundamental forms of options that you may invest in. You can acquire stock shares at a specified price (the strike price) on or before the option’s expiration date if you buy call options. Put options allow you to sell shares at a certain price on or before the expiration date of the option.

Drawbacks of options

Also, certain options methods are riskier than others, so be sure you know what you’re getting into before you start.

Which is Better? Stocks or Options

As you get more familiar with stocks and options, you’ll see that these two are way different from each other. Some of them are stated below:

Ownership

The most significant distinction between options and stocks is that stocks reflect shares of ownership in specific firms, whereas options are contracts with other investors that allow you to wager on which way a stock price moves. Regardless of their differences, these assets can work well together in a portfolio. When you buy shares, you become a stakeholder in the firm right away. Option holders have the right to purchase shares in the future.

Manner of Purchase

Another significant distinction between the two types of equity pays in the manner of stock purchase. This has a significant influence on both the individual and the organisation, but it’s not usually taken into account. We propose that you consider this carefully when deciding which type of equity compensation to utilise to avoid future problems.

Investors

Stocks are best for beginner investors like startups, long-term investors, and hands-off investors whereas options are made for active traders, scaleups, and advanced investors.

Deciding Prices

Stock prices are largely determined by market forces and corporate fundamentals such as earnings projection, product performance, and so on. The price of the underlying stock, the time to expiration, and other factors all have a role in stock option pricing.

Voting Rights

If you own stock in a business, you get voting rights and a portion of the company’s dividends, but stock option holders get no dividend and no voting rights.

Handling

Stocks do not need as much care. Stock options, on the other hand, are more volatile and require more attention.

Conclusion

Whether you should invest in stocks or options is completely a personal decision based on your investment approach. For the most part, novice investors and those who want simplicity, stick to stocks due to their plain nature. Options may appeal to those who want an active investment strategy and enjoy watching the market. Never limit yourself to one asset. After all, options traders automatically become stock investors when they exercise call options. Many stock traders, on the other hand, utilise put options as a hedging strategy. Whatever you choose, be sure you fully comprehend what you’re doing first.

To summarise, both stock and options have significant portfolio tools for an investor, with stocks being ideal for long-term investing and options being better for those who want flexibility and risk reduction through hedging.

Amit Khanna, 7startup Founder

Amit has 18 years of experience in the industry and an MBA. He supports entrepreneurs with every aspect of their business including concept and product development, investor presentations, and fundraising. Amit & 7startup assist startups in the pre due-diligence process and help connect them to our vast network of investors. Reach out to us today and see if we’re a fit!