Building a startup is difficult. As a startup founder, you are focused on developing your product, hiring top talent, and raising capital. There are several options for funding your startup. To grow their business, most startups rely on capital they receive from various sources, depending on which of the startup funding stages they’re in. These can be from personal/family and friend capital, customer revenue, debt financing, or venture capital.

Building a startup is difficult. As a startup founder, you are focused on developing your product, hiring top talent, and raising capital. There are several options for funding your startup. To grow their business, most startups rely on capital they receive from various sources, depending on which of the startup funding stages they’re in. These can be from personal/family and friend capital, customer revenue, debt financing, or venture capital.

Finding the initial capital for your startup can feel nearly impossible when it is first launched. Most founders seek venture capital if they do not have personal or friends/family capital. If a startup decides to raise venture capital, it will most likely do so in multiple rounds and at various stages.

For example, when you raise the first capital for your business, this is referred to as the seed stage. The round names evolve as you grow and raise more capital. Following the seed stage, there is Series A, Series B, Series C, and so on. Below, we define and delve deeper into the various startup funding stages.

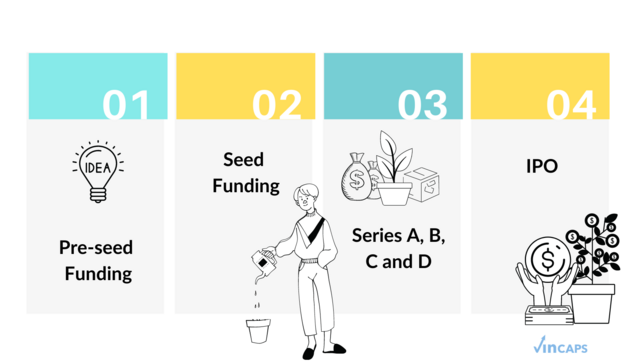

Pre-Seed Funding Stage

Pre-seed funding has emerged as a new startup funding stage in recent years. This stage occurs so early in the process that it is not even considered a true startup funding stage. The pre-seed funding stage generally refers to the time when a startup is getting its operations up and running. During the pre-series stage, investors are unlikely to make an investment in exchange for equity in the startup. This stage can last a long time or you can receive pre-series funding quickly. It is determined by the nature of your startup as well as the initial costs that must be considered while developing the business model.

Pre-seed is typically the first round of institutional capital raised by a startup. In general, a pre-seed round allows a founding team to find product-market fit, hire early employees, and test go-to-market models. The size of pre-seed rounds varies greatly between companies. There is no hard and fast rule. According to research, pre-seed round sizes can range from $100,000 to $5 million. Finally, when determining valuations and how much to raise, you should consider your company’s needs.

As a general rule, funding should be available for 12 to 18 months. It should be sufficient capital to allow you to comfortably meet the goals and forecast you established during the pitching and fundraising process. One advantage of a pre-seed round is that it allows for more types of investors because the check sizes are generally smaller. Good starting points might be angel investors, accelerators/incubators, and dedicated pre-seed VC funds. For further information on early fundraising, read more here.

Seed Funding Stage

Seed funding is the first of the true startup funding stages and is frequently provided by angel investors, friends and family members, and the original company founders. A startup in its early stages may seek funding through bank loans, but angel investments are usually preferred. Seed funding is used to start the company, so it carries a high level of risk. The company has yet to establish itself in the market. Many angel investors specialise in seed funding opportunities because it allows them to purchase a portion of the company’s equity when it is at its lowest valuation. Additionally, becoming an early investor allows them easier access to invest again at later startup funding stages.

Raising seed stage funding is a significant achievement for a startup. The initial infusion of capital into the business is known as seed stage funding. A startup is mostly an idea at this point, with little to no revenue. This is typically the stage at which a product and go-to-market strategy are built and developed. For more information or help on how to get funding at the seed stage, read more here, or here to learn more about seed investors.

Following the completion of a seed round, a founder has three options. The first, and most common, is discovering that the time is not right for the startup, and the startup fails. The second is discovering that the seed stage capital was all that the company needed to get started and that it can fund the business’s growth through customer revenue and debt financing. The final and most traditional route is to raise future startup funding rounds such as Series A, Series B, Series C, and so on.

Series A Funding Stage

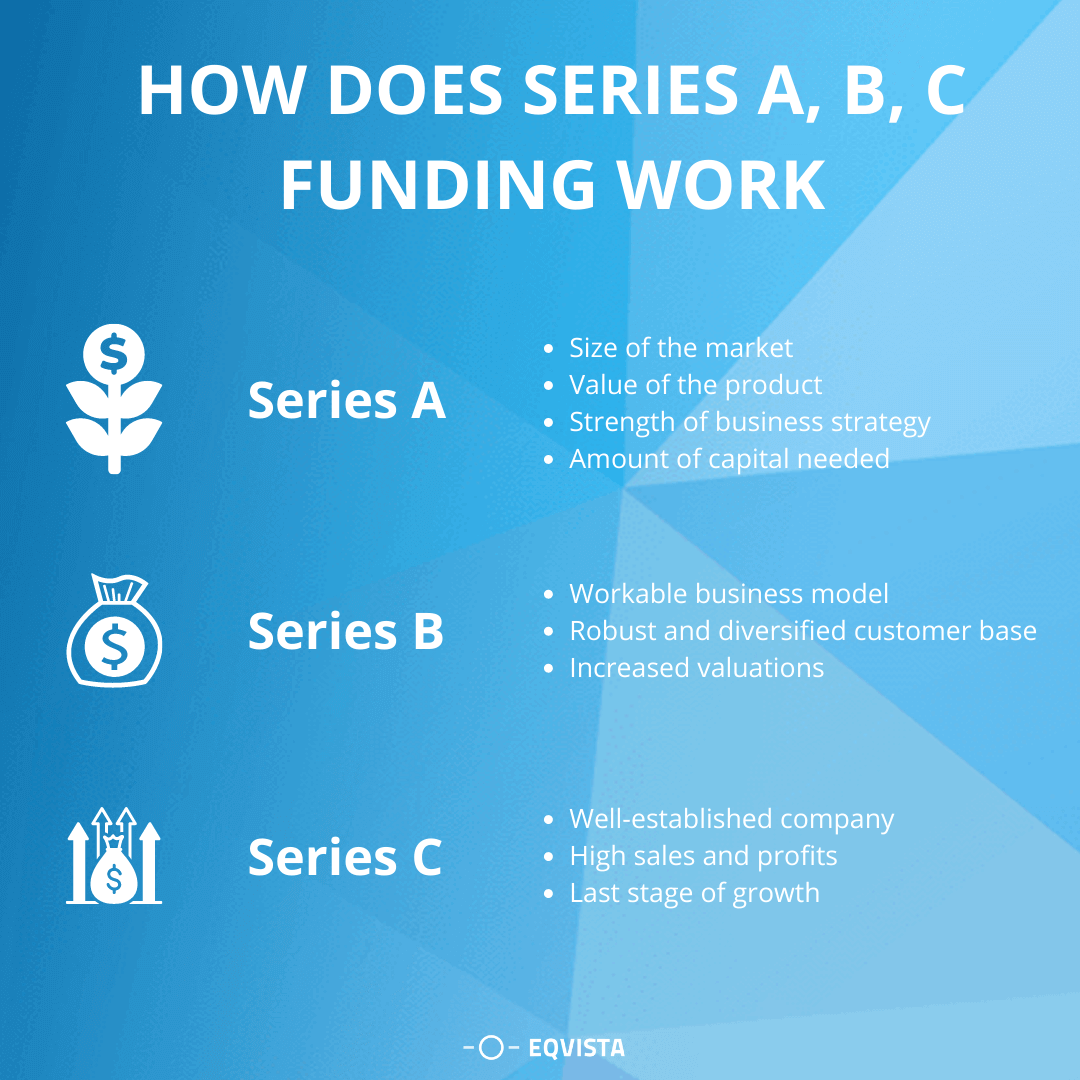

After raising a seed round, it’s time to move onto later startup funding stages. The prospect of Series A funding can be intimidating for many startups, but it can also be a make or break moment for a company. Stock options are typically sold to the company’s founders, those close to them, and angel investors when the company is first founded. Following that, a preferred stock in the form of a Series A can be sold to investors. Series A allows investors to get in early on a company in which they have a strong belief. It’s a win-win situation for both the company and the future stockholders.

Series A funding can be challenging because it also necessitates a Series A valuation. The company must be valued and priced at the time of Series A funding. Previous investments must be considered, as previous investors will have purchased the business at a specific valuation. If an angel investor invested $100,000 in the company just months ago, new investors may be hesitant to invest at a $10,000,000 valuation today.

The average Series A funding round has grown substantially over recent years, jumping 30% from 2020 to 2021, ending the year at $22.2 million. Currently in 2022, the average is above $23 million as well. It is, however, important to note that this average being referenced is the mean round size for this startup funding stage, and is much higher than the median. In 2021, the median early funding stages size, which includes both Series A and Series B, was around $8 million.

Acquiring Series A Funding

A company’s valuation is influenced by a variety of factors, including management, size, track record, risk, and potential for growth. Analysts can be called in for a professional business valuation. During a Series A funding round, a company usually does not have a proven track record and may be more risky. During a Series A round, investors can typically purchase 10% to 30% of the company. Series A investments are typically used to expand the business, often in preparation for market entry. During its Series A round, the company will be able to decide how much it wants to sell and may want to retain as much company control as possible.

Following the completion of the funding round, the company will typically have working capital for six to 18 months. From there, the company may be able to go to market or move on to the next round of funding. The Series A, B, and C funding rounds are all based on the stages of development that the company goes through. It is critical to remember that when you raise your Series A, you are establishing goals and objectives for what that capital will do for your company. You must raise sufficient capital to help you achieve these objectives so that you can proceed to raise a Series B or future round of capital.

Series B Funding Stage

After a company has been launched and established, it may require Series B funding. A company will only receive Series B funding after it has begun operations and proven its business model. Series B funding is typically less risky than Series A funding, so there are more interested investors.

The company begins with a valuation, as it does with Series A funding. From there, it announces that it is seeking Series B funding. The company will sell its equity at the agreed-upon valuation, and investors are free to make offers based on that valuation. A startup that receives Series B funding is already more successful than many startups that do not raise more than their initial seed capital. The average amount of capital raised during this startup funding stage is around $33 million.

Acquiring Series B Funding

Series B funding is sometimes provided by the same investors who provided Series A funding. In other cases, Series B funding may come from additional investors or investment firms. In either case, investors will typically pay more for less equity than they did in previous funding rounds because the company’s valuation will have scaled. A Series B funding valuation must take into account the company’s current performance as well as its future growth potential.

Analysts can be used to determine the value of a company seeking Series B funding. It should be noted, however, that the company has more negotiating power as a Series B company because it has proven to be successful.

After obtaining Series B funding, the company must use the funds to further stabilise, improve its operations, and grow. The startup should be in a good position at this point. If the startup requires additional funds to grow and expand after it has developed, it may need to embark on a Series C funding round.

Series C Funding Stage

Series C funding is intended for startups that have already proven their business model but require additional capital for expansion. Like Series B investors, investors at this stage are frequently entrepreneurs and individuals who have previously invested in the company. When seeking Series C funding, a startup may first approach its angel investors, Series A and Series B investors. If a startup has received Series C funding, it is already quite successful. Unlike earlier stage rounds, which are used to help a startup gain traction and grow, by the time a startup raises its Series C round, it has already established itself and is growing.

Because the company is already established and only requires funds to grow or expand, it is less likely to be a risk. At this point, the startup is no longer a “startup,” but rather a well-established company with a proven business model that needs to expand its product offerings, enter new markets, or increase its marketing output. A company can make strategic investments by raising a Series C round. This could imply investing in market expansion, new products, or even the acquisition of other businesses. The average size at this startup funding stage is generally around $50 to $60 million.

Acquiring Series C Funding

When approaching a Series C, the strategy will most likely differ from previous rounds. As previously stated, the average is around $50M. This means that earlier round investors with checks ranging from $1 to $5 million are less likely to lead a round. Previous investors may be eager to invest in your Series C, but startups will need to raise the remaining funds from other sources. Your company will most likely speak for itself and receive more inbound investor requests. These investors are likely to be later-stage venture capital funds, private equity firms, and banks.

Later Startup Funding Stages

Depending on the business strategy, a Series C round of venture capital financing may be the end of the road. At this point, the company is most likely on the right track and controls a sizable portion of the addressable market. Some companies, however, go on to raise their Series D, Series E, Series F, and even Series G.

Series D Funding Stage

If the company’s Series C funding round was insufficient, a Series D funding round may be held. This frequently has business ramifications. Series D funding occurs when a company was unable to meet its targets with its Series C funding, and as a result, the company’s valuation has dropped. Being priced at a lower valuation is usually very bad for a company.

If Series D funding is required due to the company’s current challenges, it may be the only way for the startup to survive. However, it devalues the company in general and may shake future investor confidence.

Series E Funding Stage

If Series D funding is insufficient to meet the company’s capital needs, Series E funding may be required. This is, once again, a very bad sign, and very few companies will make it to Series E funding. Series E funding will only be granted if the company has not been able to raise its own capital and is still struggling to remain active and private.

Series F & G Funding Stages

Finally, while very few companies will receive Series F or Series G funding, it is possible. Because capital is so central to their operations, some well-known financial services have received Series F or Series G funding. Every round of funding represents a new opportunity for the company, but it also has the potential to dilute the company’s equity and valuation. Like with the other later startup funding stages however, it is typically not the best look.

Initial Public Offering (IPO)

The process of offering corporate shares to the general public for the first time is known as an IPO. Growing startups in need of funding frequently use this process to raise funds, whereas established organisations use it to allow startup owners to sell some or all of their ownership to the general public.

When a startup decides to go public, a series of events takes place during the IPO process. These are:

- The formation of an external public offering team composed of underwriters, lawyers, CPAs, and SEC experts.

- Compilation of startup information, including financial performance and anticipated future operations.

- An audit of the startup’s financial statements is performed, resulting in an opinion about its public offering.

- The startup submits its prospectus to the SEC and sets a date for going public.

The ability to raise funds for a startup is not the only advantage that entrepreneurs gain from a public offering. Other benefits include:

- Because it already has access to public markets, a public organisation can generate additional funds through secondary offerings.

- Many public companies compensate executives with stock. The stocks of a public organisation are more attractive to employees as the stocks can be sold easily. Being public also allows an organisation to attract better talent.

- Mergers are simpler for a public company because it can use its public shares to acquire another startup.

Conclusion

Entrepreneurs can scale their startup at any stage of their entrepreneurial journey thanks to the various startup funding stages. This scaling practise enables them to determine where their startup stands and which potential investors would invest in them to help it grow. And for more information on raising funds for your startup, read our related blog post Fundraising for Startups.

Remember that startups must be mature enough to qualify for a specific funding round in order to receive funding. The net worth of your startup can tell you where it stands.

Many startup founders retire after their companies go public. Many of them would rather become angel investors and invest their hard-earned money in other startups. After all, they’ve earned the right to unwind and advise other entrepreneurs on how to grow and profit from their startup.

Amit Khanna, 7startup Founder

Amit has 18 years of experience in the industry and an MBA. He supports entrepreneurs with every aspect of their business including concept and product development, investor presentations, and fundraising. Amit & 7startup assist startups in the pre due-diligence process and help connect them to our vast network of investors. Reach out to us today and see if we’re a fit!