Forecast revenue and growth rate may seem a tedious task when spending time on business planning but in fact it’s a critical part of managing a startup. A financial forecast allows you to predict your earnings and how your business will fare in the future, whilst also playing a role in helping you avoid unexpected costs and cash flow shortages as your business grows.

Getting an accurate sense of your revenue projections will also tell you what you can afford to do and indicate what steps you may need to take to accelerate the development of your startup. Forecasting future revenue can therefore help give you a series of reality checks about your business and its future.

Using Revenue and Growth Predictions in your Pitch Deck

If you’re looking to seek investment from funding investors such as Venture Capitalists or Angels, then having an accurate revenue projection in your pitch deck will help them decide whether your startup is a viable investment or not.

Remember, however, to always remain realistic and show potential investors that you take your business as seriously as they should take you. It’s always better to show accurate forecasts alongside honest future growth predictions. Purposefully lying about these figures could be considered fraud.

If you need help writing the pitch deck for your startup, contact one of our expert advisors for personalised guidance and advice.

Top tips for forecasting revenue and growth of your startup

Forecast your expenses first

Pre-revenue stage businesses may find predicting sales and profit difficult and early-stage startups are less likely to be able to do this accurately. Consequently, it’s much easier to forecast expenses first since you’re more likely to already know what they are. By outlining all fixed overheads, you’ll know how to control your spending so as to maximise the potential of your business in the future.

Common categories of the expenses you should consider are:

Overhead, fixed costs:

- Rent

- Utility bills

- Phone bills

- Technological expenses

- Salaries

- Bookkeeping and accounting

Cost of goods:

- Packaging

- Materials and supplies

Cost of direct labour:

- Direct marketing

- Direct sales

- Customer service

Other points to consider

You should think about purposefully overestimating expenses such as funds for a marketing campaign, insurance, and legal fees since these are likely to exceed expectations.

Furthermore, if you carry out certain services yourself, such as customer service, remember to factor in the labour expenses this would cost if you were to hire someone to do this in the future.

Calculate your Financial rRatios

There are certain ratios concerning your business that you should work out in order to achieve accurate forecasting. These include:

Gross Margin

Calculating your gross margin involves working out the ratio of direct costs to total revenue during a given quarter or year. This can help you predict revenue growth and sales growth.

Costs : Total revenue

Operating Profit Margin

This is the ratio of operating costs (direct costs and overhead, not including financing costs) to total revenue in a given quarter or year. Working this out can help you set achievable revenue goals to stimulate business growth and expansion.

Operating costs : Total revenue

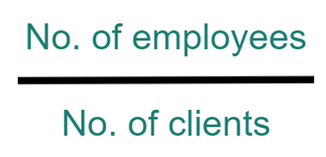

Total headcount per client

To work out the total headcount per client, divide the number of employees at your startup by the total number of clients it has. Once you have the answer, consider whether this ratio will be feasible in the future when your business has expanded.

If not, then you will need to think about the cost of employing more staff to help share the workload and take your business even further. This will also demonstrate the scalability of your startup to potential investors but must not indicate a dilution in equity in your business.

Break-even point

This should predict at which point your startup will begin to break even and how long it will take to get there. VCs and Angels are particularly interested in this information as they want to know the profitability of your business before they make an investment.

Take both an aggressive and a conservative approach

When developing your forecasted revenue, maintain a balance between aggressive and conservative predictions. Aggressive, more optimistic projections help keep you focused and motivated to succeed, whereas a conservative financial projection sustains a sensible approach to your business’s future performance. Common approaches to determining accurate sales revenue forecasts sometimes include taking both an aggressive and conservative approach in two separate predictions, so if time and resources allow, you may even want to consider forecasting expenses this way, too.

Summary

Taking the time to calculate your startup’s revenue and growth projections is an important part of being a business owner. It is especially important for early-stage startups to determine a projected revenue as planning out your business’s future revenue can help you plan for periods of cash flow shortages and surprise costs.

A detailed revenue forecast should also be included in any pitch decks presented to VCs or Angels as this will increase the attractiveness of your startup. Revenue forecasting methods include the consideration of expenses and fixed overheads which will help you gain control over your spending. You can choose to create conservative or aggressive revenue forecasts and even opt to do both if you are able. Financial forecasting should also consider your business’s key ratios, such as your gross margin, operating profit margin, and total headcount per client.

Amit Khanna, 7startup Founder

Amit has 18 years of experience in the industry and an MBA. He supports entrepreneurs with every aspect of their business including concept and product development, investor presentations, and fundraising. Amit & 7startup assist startups in the pre due-diligence process and help connect them to our vast network of investors. Reach out to us today and see if we’re a fit!